U.S. Is Driving ASEAN Closer to China

Washington cedes key geopolitical battleground by its own design

For those locked in a great-power rivalry, courting key regional actors is the name of the game. The Association of Southeast Asian Nations (ASEAN), arguably the most successful regional bloc after the European Union (EU), would surely fall into this category. Representing nearly a tenth of the world’s population and anchoring critical nodes of global supply chains, the region has emerged as a key arena for power projection by Beijing and Washington, and as a touchstone of their diplomatic prowess.

China appears to have made some progress in this regard. The ongoing China-ASEAN Expo (CAEXPO), held in the southern Chinese city of Nanning for 22 years in a row, has drawn a large number of high-ranking ASEAN officials and exhibitors. A fortnight earlier, six ASEAN leaders, among 26 foreign dignitaries, ascended the Tian’anmen Rostrum and beheld China’s grand military parade, an event alarmingly shunned by the West. The Indonesian President Prabowo Subianto, in particular, proceeded with his Beijing tour despite recent domestic unrest.

Yet, while Washington continues to profess its commitment to regional partnerships, its insistence on compelling Southeast Asian nations to choose sides has not been well received. Trump’s tariff-driven approach has also struck a menacing chord in the region. This is not the first time the U.S. has projected hubris in this China-neighboring region—an attitude that once culminated in a humiliating Fall of Saigon—but it could well be the last if such aggressive momentum does not lose steam soon.

Monsoon of Tariffs

The Trump administration’s “America First” trade framework, sometimes labeled as “lone wolf” diplomacy, comprises a mix of economic coercion and unilateral withdrawal. This marks a clear departure from earlier U.S. commitments, such as the annual funding of 12 million USD for Cambodia’s de-mining programs since the 1990s. That support had been vital in helping local communities gain access to safer farmland, schools, and infrastructure, but it was suspended in 2025 as part of broader aid cuts.

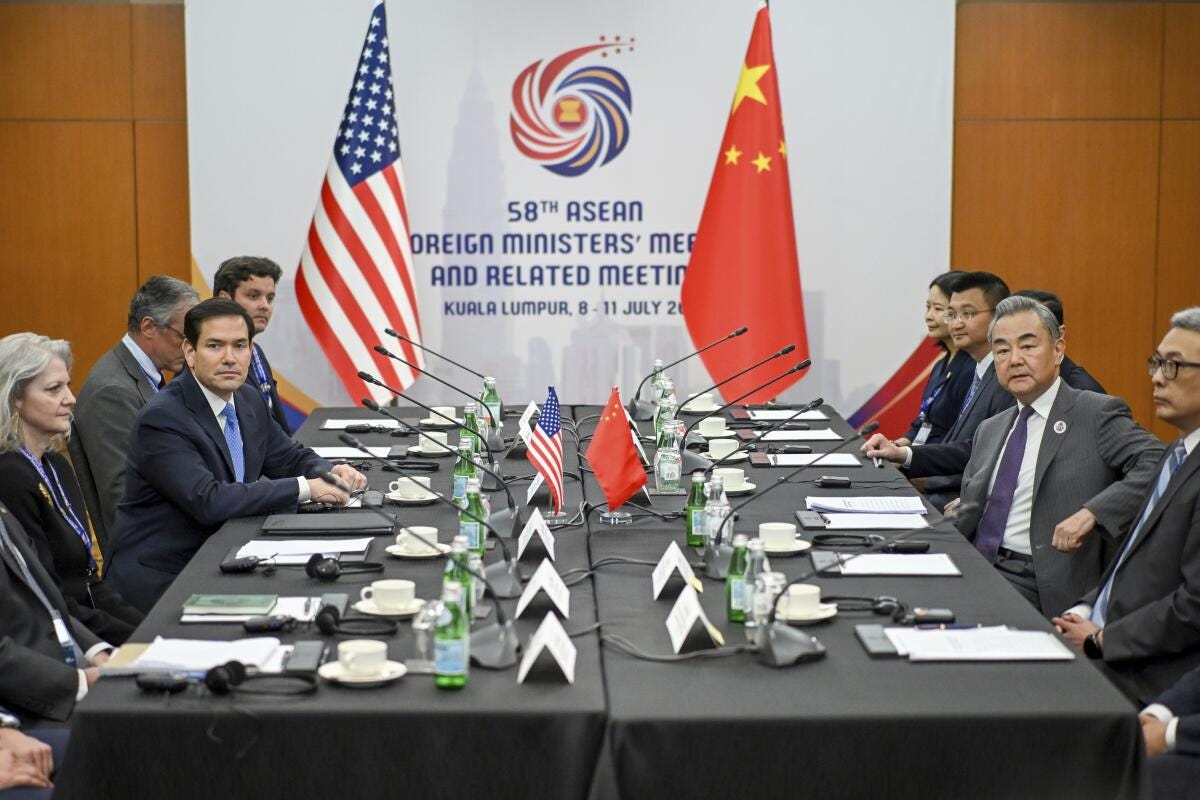

In July 2025, a U.S. delegation headed by Secretary of State Marco Rubio arrived at ASEAN meetings in Kuala Lumpur, seeking to cast the region as a “focal point of U.S. foreign policy.” Still, he fell short in his ability to reassure his counterparts as “all of these countries were receiving letters from the White House with their new tariff rates,” according to Gregory Poling, a Southeast Asia expert at Washington’s Center for Strategic and International Studies.

Amid threats of reciprocal tariffs ranging from 20% to 50% on more than 20 countries worldwide, several ASEAN members are falling prey to steep rates, including Vietnam (20%), Myanmar (40%), and Laos (40%). The levy rampage, which took effect on August 1, is expected to reduce Thailand’s GDP growth by over 1% and force Indonesia to offset its trade surplus with the U.S. by boosting 34 billion USD imports from America.

As one critic described, these coercive tactics amount to a “diplomacy of perpetual volatility,” designed to distance the U.S. from its traditional allies and coax its public into a collective state of apathy towards global affairs, prompting its partners to diversify away from the American market.

The sheer scale of U.S. policy extends beyond standard-issue protectionism. It is a deliberate act of turning back the clock on the global integration that the U.S. once evangelized. “My understanding is that the White House no longer uses the term ‘globalization,’ starting from the Biden administration, and they use ‘internationalization’ to replace it,” said Yan Xuetong, a leading political scientist at Tsinghua University. “The American government takes a very firm anti-globalization stance.”

In response to a recent earthquake in Myanmar, the U.S. scrambled a three-person team to the quake-torn area only to have them laid off on the spot, while China dispatched 600 personnel and 14 million USD in assistance. The Senate Foreign Relations Committee Minority report from this July offers a glimpse of this policy fallout: an 80 billion USD withdrawal from multilateral aid, positioning China as the top bilateral donor for over 40 countries.

For China, multilateral platforms like the annual CAEXPO, established in 2004 to promote regional trade and integration, represent a key asset in its diplomatic toolkit for engaging the region—one that the U.S. has yet to match with comparable institutions, even as Washington seeks to magnify its presence in this pivotal geopolitical battleground.

“Over the past two decades, CAEXPO has become more than a showcase of trade and investment. It has grown into a catalyst for deeper integration, innovation, and long-term growth,” said Dr. Kao Kim Hourn, Secretary General of ASEAN, at the opening ceremony of this year’s event.

U.S. Tollbooth Diplomacy

For ASEAN, a bloc whose 476.8 billion USD in U.S. trade last year employed millions of local workers, Trump’s aggressive approach of reducing trade deficits is tantamount to “extracting rent” rather than forming partnerships, according to Asma Khalid, an American independent researcher.

Deals with Vietnam and Indonesia demand mandatory purchases of American-made jets, energy, and farm produce, effectively turning market access into a “tollbooth.” As critics argue, it monetizes entry into the U.S. market, with governments subsidizing political favors, distorting the free flow of goods, and eroding competitiveness.

The wider Global South also feels the pinch. Trump’s 50% tariff on India, including penalties for its ties with Russia, illustrates how U.S. policy now punishes perceived disloyalty, fracturing trade landscapes.

In response, ASEAN emphasizes purposeful action to boost intra-regional trade, as advocated by Malaysian Prime Minister Anwar Ibrahim, serving as a hedge against volatility. Anwar’s characterization of tariffs as “the new weather of our time” aptly captures the enduring uncertainties and how trade has evolved from a tool for growth to an instrument of pressure, isolation, and containment.

This May, ASEAN held its first-ever summit with China and the six members of the Gulf Cooperation Council (GCC), laying the groundwork for emerging trilateral convergence. With 2 trillion USD in Gulf investments pledged to the U.S. to appease Trump and justify his economic playbook, ASEAN and the Gulf states have recalibrated their strategy via dual summits with China and the GCC, heralding a pivot toward diverse, sustainable partnerships.

Meilleur Derek Murindabigwi, the CEO of Rwanda-based IGIHE, News & Media powerhouse, views this as the Global South’s answer to volatility, tapping into ASEAN’s industrial base and skilled labor with the Gulf’s energy and infrastructure to build resilient trade routes less susceptible to Western whims.

“For Africa, the path is also clear,” said Murindabigwi. “Fast tracking the African Continental Free Trade Area (AfCFTA), investing in regional corridors and leveraging critical minerals and its digital economy to shift from raw exports to value-added production.”

Beijing's Steady Hand

In this maelstrom, China’s policy has burnished its reputation as a reliable partner for ASEAN and the wider Global South. As the entire world grapples with the reigning superpower’s erratic swings, Beijing continues to prioritize pragmatic engagement tailored to partners’ needs.

Recent upgrades to the ASEAN-China Free Trade Area, incorporating digital and green economy provisions, are projected to elevate 27 million people to middle-class status by 2035 via the Regional Comprehensive Economic Partnership (RCEP). China’s Asian Infrastructure Investment Bank has inked deals for climate-resilient projects, arming the likes of ASEAN against U.S.-induced shocks.

“The signing of the CAFTA 3.0 Upgrade Protocol will send a strong signal that ASEAN and China remain committed to upholding a rules-based trading system,” noted Kao. “Even amidst rising geopolitical tensions and global uncertainties, CAFTA 3.0 goes further by making technology and innovation central to our cooperation, deepening supply chain integration and regional prosperity.”

Bounthong Chitmany, Vice President of Laos, is convinced that with transparent mechanisms, along with a human-centered development approach, the China-led global (AI) governance initiative, first proposed in 2023, aligns seamlessly with ASEAN's own AI endeavor.

“China’s push for worldwide AI cooperation, which is built on ideas like open discussions, collaborative efforts, and mutual gains, will help developing nations play a substantive role in shaping AI’s future,” added Chitmany.

Observers note China’s expressed desire for greater U.S. predictability in bilateral dealings, which was evident in Foreign Minister Wang Yi’s July discussions with Rubio in Kuala Lumpur, described as “constructive” and centered on mutual respect and dispute resolution. A follow-up phone call on September 10 reinforced these points, with Wang comparing U.S.-China relations to “two giant ships” navigating forward, while Rubio stressed maintaining communication amid growing tensions over tariffs and defense.

For the other parts of the Global South, China’s outreach, such as the Belt and Road Initiative, has not only offered an alternative to U.S. capriciousness, but has also reshaped global economic geography in favor of Africa and Latin America.

“The difference lies not only in scale but in approach,” said one observer. “Unlike the U.S., which frequently ties engagement to shifting political conditions, China’s cooperation has been predictable and aligned with local development priorities.”

There has even been substantial progress on the primary challenge to China-ASEAN relations — the South China Sea. The Beijing-proposed Code of Conduct has reached a milestone with the completion of its third reading this March, demonstrating China’s measured restraint on territorial disputes with most Southeast Asian neighbors. With differences largely cast aside, China’s share of ASEAN trade rose from 12% in 2010 to 20% in 2023.

The U.S. current trade tactics reflect a notable policy adjustment: a once-open superpower now hell-bent on reversal, viewing alliances as drags and deficits as banes. As Rubio saw it, the postwar order is “obsolete” and a “weapon being used against us,” paving the way for the U.S. to lessen commitments, thus curtailing its international engagement.

As trade negotiations falter over U.S. demands for “rents,” China’s stabilizing role is well-placed to deliver the predictability that ASEAN craves: needs-focused and committed to multilateral gains. For Southeast Asian nations and beyond, aligning more closely with Beijing seems to have become a no-brainer amid U.S. bullying and disengagement.

Tian Zijun is a Xinhua journalist and researcher of Sinical China. Based in Guangxi Zhuang Autonomous Region in southern China, he is a longtime watcher of China-ASEAN affairs. Email: jeremytzj@qq.com

Xu Zeyu, founder of Sinical China, is a senior journalist with Xinhua News Agency. Email: xuzeyuphilip@gmail.com