Boeing's Wrong Lesson to Learn

Losing China's order of the century is beyond "geopolitical differences"

Last week, the US Boeing Company took a huge blow by losing China’s biggest civil aviation order to its European nemesis Airbus. The transaction order of the century, placed by China’s three leading airlines, contains 292 Airbus A320 NEO passenger aircraft with a total worth of over 37 billion U.S. dollars. The US aviation giant expressed immense disappointment that “geopolitical differences continue to constrain US aircraft exports.” Granted, the trade war waged by the US is not doing American exporters any favor in the world’s largest market. But if Boeing blames the setback entirely on the government’s harum-scarum foreign policies, it is not likely to get very far in China after all.

Chinese mainstay airlines are not the first to turn their back on Boeing. At the Paris Air Show of 2019, American Airlines took a bold step to purchase 50 new Airbus A321 XLR planes to replace the old model of Boeing 757 in its fleet. American Airlines thus became the first US carrier to endorse Airbus’ new longest-range narrowbody plane. Its bitter contender Boeing 737 MAX, on the other hand, failed to score on the same occasion.

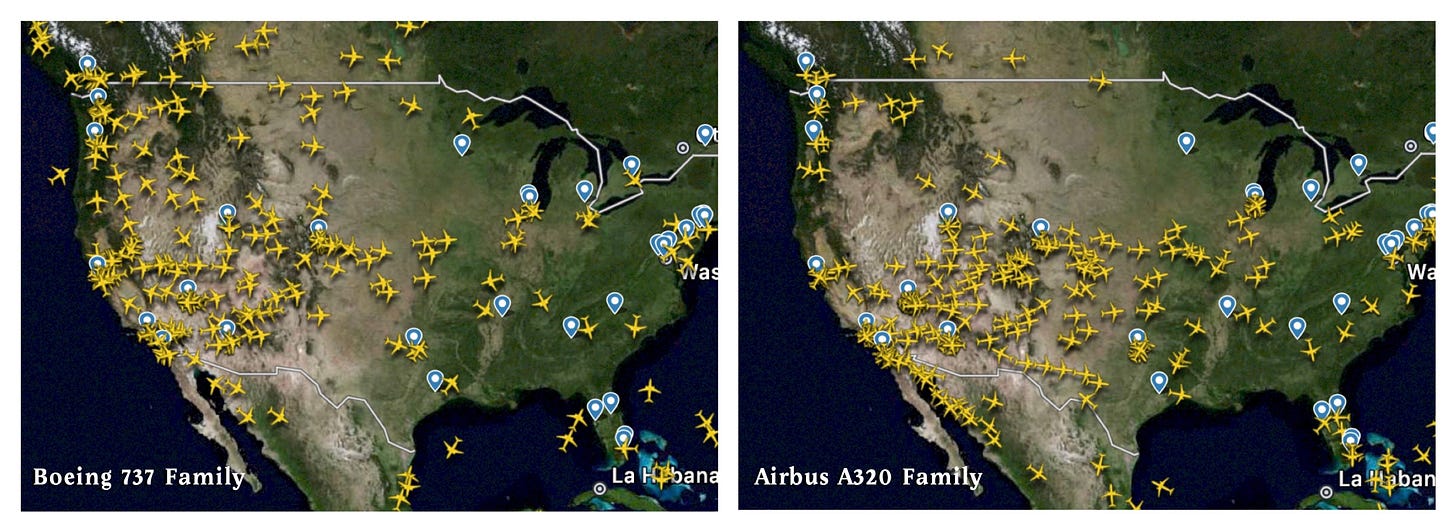

Up to now, Boeing planes are running neck to neck with Airbus even in its home market. According to the real-time aviation map maintained by Flightradar24, a third-party aviation data platform, the B737 models flying over American soil are not numerically superior to A320 family (see the map below). It is yet another sign that the tie is turning against Boeing on global scale, and not because of geopolitical concerns.

Fueling the Blanks

It is no coincidence that the fuel efficient A320 NEO was featured in the China deal. Following Western countries’ sanction against Russia amid the Ukrainian Crisis, the jet fuel prices almost doubled in the past twelve months. Considering fuel accounts for around half of a flight’s cost, Chinese airlines could easily be just as susceptible to the soaring fuel prices as their American counterparts. Airbus A320 NEO, consuming 20% less fuel than its previous models, has risen to global favor with over 8,000 orders since its launch in December 2010.

Boeing’s answer to A320 NEO is B737 MAX, but it came out late and in a hasty manner. Nine days after the first A320 NEO was delivered to the Germany’s Lufthansa in January 2016, B737 MAX rushed to its maiden light. It was not until May 2017 that Boeing’s new airliner was delivered to its first customer Batik Air Malaysia. As a stress response from both the competitor’s advance and surging market demand, B737 MAX had yet to prove itself to be a valid long-term choice for global airlines.

As far as China’s civil aviation market is concerned, both B737 and A320 family meet the need of China’s domestic flights, and Chinese buyers balanced the purchases from each side for a long time. However, the COVID-19 pandemic has taken its toll on Chinese airlines with massive cut on both domestic and international flights, and economic concerns have been given much more weight. Whichever proves more solid wins.

Sudden Plummets

Unfortunately, two deadly air crashes painfully exhibited Boeing’s fatal human errors in its desperate chase after the chief rival. In 2018, a B737 MAX8 airliner (a model of B737 MAX family) of Indonesian Lion Air, with 189 people on board, crashed 13 minutes after its take-off from Jakarta. In 2019, the same model of Ethiopian Air suffered the same fate, ending in a fatality of 149 passengers (8 of them were Chinese) and 8 crew members. On the next day of the second air crash, Civil Aviation Administration of China (CAAC) was the first in the world to ban all commercial operations of domestic B737 MAX fleet.

After an 18-month investigation, a US House panel concluded that the crashes were “the horrific culmination of a series of faulty technical assumptions by Boeing’s engineers, a lack of transparency on the part of Boeing’s management, and grossly insufficient oversight by the FAA.” In the report, Boeing was criticized for withholding crucial information from the FAA, its custormers, and B737 MAX pilots. This grave breach of laws and the codes of conduct has plunged B737 family to rock bottom, and the global confidence in Boeing Company hasn’t recovered ever since.

There were also profound economic implications for B737 users in China. A total of 96 aircraft of B737 MAX models were grounded in China, including 54 from Air China, China Southern Airlines and China Eastern Airlines, the three buyers in the Airbus order last week. According to China Air Transport Association, Chinese airlines would expect a loss of 600 million U.S. dollars if CAAC’s ban on B737 MAX would last till June 2019. In fact, B737 MAX didn’t regain air worthiness in China until last December, and there is a whole process of renovation and crew retraining to go through before the fleet hit the sky. As China starts to relieve its COVID control measures and resume domestic passenger flights, these airlines are rightfully concerned about their capacity to stay level with an awakening market. A320 NEO seems the obvious choice.

Freedom of Choice

Apart from the economic and security factors, what falls short in Boeing’s calculation is how China’s market economy operates. What is deemed as China’s statecraft in geopolitcal gambits is in effect the initiatives from Chinese market entities. Chinese airlines have a high degree of freedom in choosing their own planemakers and they tend to use it.

Take regional airlines as an example. Xiamen Air, booming fast in recent years, furnishes its fleet with all Boeing planes, including 213 models of B737 family. Based in East China’s Fujian Province, this airlines hired over 100 air stewardesses from Taiwan due to geographical proximity. Sichuan Airlines, on the other hand, operates with an all-Airbus fleet with 185 models from A320 family. Their major concerns are usually related to business focus, pilot training, fleet maintenance and cost-benefit ratio. The same applies to national airlines. Only that the three leading flight companies have a balanced number of Boeing and Airbus planes, just in case of major upheavals like the ban on B737 MAX.

The order of the century further shifted the balance against Boeing’s favor, but the US planemaking powerhouse should not panic and learn the lesson right. The animosity of China-US high politics played a role, and US exporters could find it hard to further bilateral trade with obstacles set up by China hawks in Washington. Nevertheless, Boeing need to face the fact that it is losing competitive edge due to poor decision-making, loose management, and misunderstanding of Chinese market environment. And that might be a good first step to get back on its wings.

(Subscribe to Sinical China for more original pieces to help you read Chinese news between the lines. Xu Zeyu, founder of Sinical China, is a senior correspondent with Xinhua News Agency, China’s official newswire. Follow him on Twitter @XuZeyu_Philip.)

Disclaimer: The published pieces in Sinical China reflect only the personal opinions of the authors, and shall NOT be taken as Xinhua News Agency’s stance or perception.